Humanitarian Cash Assistance in the 21st Century: The Use of Cryptocurrency

Wesli Turner, MSc., Research Analyst, Leadership & Governance Policy Lab

wturner@africacfsp.org

This article explores the history of digital currency in Sub-Saharan Africa, the use of cryptocurrency in humanitarian aid and the innovative use of cryptocurrency to distribute Universal Basic Income to vulnerable populations in need. This article will also touch on the role digital currency played during the height of COVID-19 in providing immediate cash assistance with limited human contact.

Introduction

Direct cash transfers have been proven to be the most effective and efficient way of distributing humanitarian assistance.1Building Blocks: Blockchain for Zero Hunger – Graduated Project (World Food Program, Geneva, 2021). https://innovation.wfp.org/project/building-blocks (accessed June 27, 2021) This is reflected in the steady increase in its use. In 2019, cash programming accounted for 17.5% or $5.6bn of total international humanitarian assistance compared to 2.5% in 2015.2José Jodar, Anna Kondakhchyan, Ruth McCormack, Karen Peachey, Laura Phelps, Gaby Smith, The State of the World’s Cash 2020: Cash and Voucher Assistance In Humanitarian Aid, (n.p., The Cash Learning Partnership, 2020). https://www.calpnetwork.org/wp-content/uploads/2020/07/SOWC2020_Full-report.pdf (accessed July 20, 2021) Cash transfers not only support local economies, but also empower beneficiaries to address their own needs. However, cash distribution depends on local financial institutions which, depending on the country and context, can be insufficient or unreliable. In addition, being displaced or lacking proper government issued identification can be a barrier to opening a bank account. Since 2017, there has been a growing shift within humanitarian response away from traditional cash distribution towards the use of digital currency including cryptocurrency using blockchain technology which allows transactions to go directly to the recipient without the need for third parties, making money transfer easier while eliminating prohibitive fees. During the COVID-19 pandemic, humanitarians leaned on cryptocurrency to assist with cash transfers while abiding by social distancing regulations. While cryptocurrency has its challenges, such as limited Bitcoin Automated Teller Machines (BATM) and lack of recognition as legal tender by some merchants and banks, it is a viable alternative source of payment and is particularly useful in humanitarian contexts.

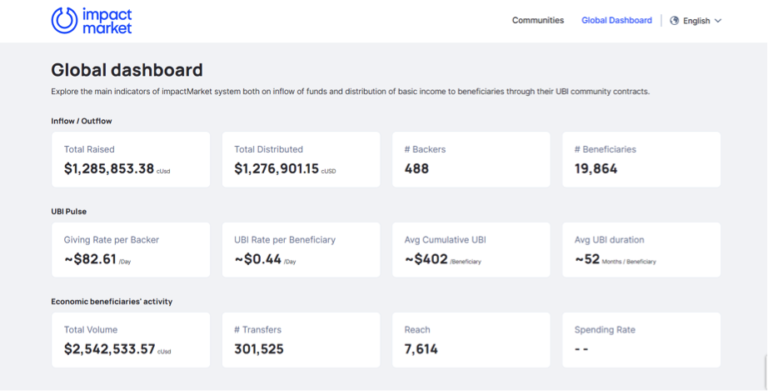

Blockchain technology (not cryptocurrency itself) provides a more transparent, accountable, efficient, and secure way of distributing cash, particularly to individuals who may not have the necessary identification or government documentation to open a bank account or have the minimum amount of cash on hand to open and/or keep an account active. Cryptocurrency and blockchain technology therefore address common problems faced by organizations providing humanitarian cash programming.3Giulio Coppi and Larissa Fast, Blockchain and distributed ledger technologies in the humanitarian sector, HPG Commissioned Report (London, Overseas Development Institute (London, ODI, 2019). https://www.econstor.eu/bitstream/10419/193658/1/1067430997.pdf (accessed June 27, 2021) It is also important to note, that cryptocurrency is not necessarily in competition with banks, but serves as a potential solution for unbanked populations. Since 2017, humanitarian organizations have begun exploring ways to incorporate cryptocurrency and blockchain technology within their cash distribution programs. Such developments include AIDcoin which enables people to give to charities in a transparent way, as well as innovations by UN Women,4UN Women- WFP Blockchain Pilot Project for Cash Transfers in Refugee Camps: Jordan Case Study, (Geneva, UN Women, 2021). https://jordan.unwomen.org/en/digital-library/publications/2021/un-women-wfp-blockchain-pilot-project-for-cash-transfers-in-refugee-camps-jordan-case-study (accessed June 27, 2021) UNICEF,5Blockchain Learning Hub, (Geneva, UNICEF, 2019). https://www.unicef.org/innovation/blockchain-learning-hub (accessed June 27, 2021) and the World Food Program.6Building Blocks: Blockchain for Zero Hunger – Graduated Project (World Food Program, Geneva, 2021). https://innovation.wfp.org/project/building-blocks (accessed June 27, 2021) New to the scene is impactMarket. Established in November 2020, it is an open and free digital platform that allows the creation and distribution of unconditional basic income to beneficiaries forming communities, according to their needs.

During the pandemic, the ability to provide funds securely and with limited in-person contact increased its appeal. In fact, platforms such as impactMarket, which uses cryptocurrency and blockchain to provide a Universal Basic Income (UBI) for vulnerable communities, including refugees, around the world saw an uptick in engagement.7Decentralized anti-poverty system, (n.p., ImpactMarket, 2021). https://www.impactmarket.com/ (accessed June 27, 2021)

Background on Blockchain and Cryptocurrency in Humanitarian Aid

Satoshi Nakamoto, conceptualized the use of blockchain technology in 2008 through the development of Bitcoin and it has since evolved and found its way into many applications beyond cryptocurrencies.8Gwyneth Iredale, History of Blockchain Technology: A Detailed Guide, (n.p., 101 Blockchains, 2020). https://101blockchains.com/history-of-blockchain-timeline/ (accessed June 27, 2021) Blockchain technology is a process of recording transactions and tracking assets within a secure peer-to-peer network.9What is Blockchain? Blockchain Technology Explained Simply, (n.p., Youtube, 2019). https://www.youtube.com/watch?v=2yJqjTiwpxM (accessed June 27, 2021) Blockchain technology first made its way into the wider humanitarian and development sector in 2017 with the Humanitarian Blockchain Summit.10Humanitarian Blockchain Summit 2017, (New York, Institute of International Humanitarian Affairs (IIHA) at Fordham University, 2018). https://blockchain4aid.org/resources/humanitarian-blockchain-summit/ (accessed June 27, 2021)

Digital Money in Africa

Digital currency is not a new phenomenon for Africa. Kenya’s major mobile operator Safaricom first introduced digital currency to the continent back in 2007 through Mobile Pesa (Swahili for money) known as M-PESA.11Daniel Cawrey, Bitcoin and M-PESA: Why money in Kenya has gone digital, (n.p., Coindesk, 2013). https://www.coindesk.com/bitcoin-and-m-pesa-why-money-in-kenya-has-gone-digital (accessed July 12, 2021) M-PESA provides payment and financial services, even if a customer has no access to a bank account. Today, the service has 42 million users across the Democratic Republic of Congo (DRC), Egypt, Ghana, Kenya, Lesotho, Mozambique, and Tanzania, demonstrating an appetite in Africa for digital currency.12What is M-PESA, (n.p., Vodafone). https://www.vodafone.com/about-vodafone/what-we-do/consumer-products-and-services/m-pesa (accessed July 12, 2021) M-PESA also uses blockchain technology for its platform Pesalinks which is a real time cash transfer platform. In partnership with the World Food Programme, it is used in humanitarian programming to support food vouchers distributed in the Kakuma and Dadaab refugee camps in Kenya.13What is M-PESA, (n.p., Vodafone). https://www.vodafone.com/about-vodafone/what-we-do/consumer-products-and-services/m-pesa (accessed July 12, 2021) While M-PESA has an established market within Africa, this has not stopped cryptocurrency firms from entering the digital currency market, most notably BitPESA in 2013 and Wala in 2017.14Kolade Aderele, Blockchain in Africa: A Tale of Two Ventures, (n.p., LinkedIn 2019). https://www.linkedin.com/pulse/blockchain-africa-tale-two-ventures-kolade-aderele/ (accessed July 12, 2021)

BitPESA has a small but steady customer base, approximately 6,000 users generating an estimated $10,000,000 in trade volume per month in 4 of the 7 countries it currently operates. Wala on the other hand was initially successful with more than 2,000 unique users in Uganda and South Africa.15Leigh Cuen, Wala Was Africa’s Perfect Crypto Success Story – Until It Collapsed, (n.p., Coindesk, 2019). https://www.coindesk.com/wala-was-africas-perfect-crypto-success-story-until-it-collapsed However, according to the founder Tricia Martinez lack of infrastructure created mistrust among users and challenges for the company. According to Martinez, “Our partners’ systems (products and services like airtime, data, and electricity) would regularly turn off due to internet problems and/or their own poor infrastructure which meant our users were unable to transact, which was the biggest use case for Dala.”16Tricia Martinez, Dala: Where Things Went Wrong, (n.p., Medium, 2019). https://medium.com/@triciatita/dala-where-things-went-wrong-a73af2583c78 These challenges were insurmountable for Wala, and in 2019 the company closed its doors. However, as demonstrated by BitPESA’s success, there are ways to overcome such challenges.

impactMarket

Africa’s history with digital currency and the opportunity it presents, has encouraged others to try their hand in the market. Frustrated with the lack of accountability and tracking mechanism of the traditional money transfer system, according to Hiba Boujnah, an advisor with impactMarket.17Interview with Hiba Boujnah, May 25, 2021 The motivation behind impactMarket was to create a platform where people could donate directly to communities they care about in a fully transparent and decentralized way. The online platform can be downloaded to a mobile device either on iOS or Android. The platform uses the Celo dollar as cryptocurrency and relies on the Valora digital wallet. The project has been backed by individuals, foundations, and private corporations.18Celo Overview, (n.p., Celo, 2021). https://docs.celo.org/overview (accessed June 27, 2021)

The goal of the initiative is to provide a universal basic income (UBI) to help lift vulnerable people out of poverty. The amount a beneficiary receives varies depending on their location. For instance, the daily rate for the Philippines is $2.00 while in the favelas of Brazil it is $0.75 a day. The money accumulates over time with the total amount reaching between $200 and $400. The unique approach of impactMarket goes beyond the use of cryptocurrency and blockchain, but includes the ability of any individual, organization, or entity to establish a “community” within the platform and allows anyone to donate directly to those individuals through the community smart contract. Hiba highlights the benefit of the system, “it is very fast in the sense that you send money, and the money is there instantly, which is a huge value because (…) vulnerable people sometimes cannot afford to wait (…).”19Hiba Boujnah, Interview by Wesli Turner, Zoom Interview. (Harare, May 25, 2021)

Currently, impactMarket is active in 22 countries, 11 are located on the African continent. In addition to helping communities, the platform has partnered with Refugee Integration Organisation (RIO), an organization based in Ghana that designs and develops economic integration solutions for refugees.20Programmes / UBI, (n.p., Refugee Integration Organization, 2020). https://refugeeintegration.org/programmes/ubi-3/ (accessed June 27, 2021) Together impactMarket and RIO help 2,486 refugees to access UBI. There are currently four refugee camps benefiting from the impactMarket initiative: the Karonga Refugee Camp in Malawi, the Kakuma Refugee Camp in Kenya, and the Ampian, Egyeikrom, Fentenaa, and Krisan Refugee Camps in Ghana. The benefit of the non-traditional system as noted by Hiba is its ability to have an instant impact. “(…) One of the biggest challenges for the humanitarian field is showing impact.”21Interview with Hiba Boujnah, May 25, 2021 The creators of impactMarket have been able to see direct impact through self-reported success stories. Examples include a refugee who saved his monthly UBI payments in order to pay for his driver’s license so that he could get a job driving, while a refugee woman used her UBI to establish the first hair salon within the Krisan refugee camp generating income for herself and her household and becoming self-sufficient. Some beneficiaries have even taken a step further and used part of their UBI to purchase phones for other community members so they can participate in the program, according to Hiba.22Interview with Hiba Boujnah, May 25, 2021 The benefit of the platform is that consumers can use the app as a bank to hold their monthly UBI until it reaches the maximum amount and withdrawal it at that time or save it. For unbanked populations that would not otherwise have access to savings account this is a direct benefit. Others, who may need the money more urgently can withdrawal the funds as soon as they are distributed, unlike traditional banks that require a wait time a funds are deposited into accounts. As a feature of the impactMarket app, beneficiaries can share their success stories with the community and the wider network.

The system is not without fault. There is an ongoing awareness of the possibility of fraud. Each beneficiary/ community member is limited to one account and is only allowed to participate once, in one community. If fraud is detected, such as more than one family member attempting to participate or a former beneficiary attempting to collect a second UBI, the entire community can be at risk of being removed from the platform. impactMarket monitors potentially fraudulent activities through an internal algorithm and also provides a mechanism to report possible fraud and misuse by community members fostering integrity for the good of every user. Other challenges of the system include accessing cryptocurrency ATMs for beneficiaries to withdraw their UBI. Since cryptocurrency is still not widely used and regulated across the world especially in developing countries where the most vulnerable live, beneficiaries usually prefer cash to crypto. However, currently, crypto exchange platforms are not available everywhere- Currently, there are 15 Bitcoin ATMs across Africa with the majority located in South Africa.23Bitcoin ATMs in Africa – Where to Find Them and How They Work, (n.p., BlockNewsAfrica, 2020). https://blocknewsafrica.com/bitcoin-atms-in-africa/ (accessed June 27, 2021) Aware of this potential limitation, impactMarket works with merchants and local economy stakeholders to ensure that when a community is established there is a means of withdrawing the cash; this often includes educating the community and merchants on cryptocurrency and how it works. Though access to cash is not a challenge everywhere and the need for it seems to depend on the size of the beneficiaries’ community. In Brazil, with more than 10,000 impactMarket beneficiaries, a wide network of merchants of all types of essential products accept Celo dollar which removes the need for beneficiaries to convert Celo dollars into any form a Fiat currency.24Interview with Hiba Boujnah, May 25, 2021

Policy

In addition to the challenges listed above, there is also a general lack of policies governing cryptocurrencies and blockchain technologies. The central banks of Ghana, Kenya, Uganda, and Zimbabwe have issued notices denouncing cryptocurrency as legal tender and issuing a warning around its use, as it is not currently regulated within the country.25Regulation of Cryptocurrency Around the World, (Washington, D.C., Library of Congress, 2018). https://tile.loc.gov/storage-services/service/ll/llglrd/2018298387/2018298387.pdf (accessed June 27, 2021) As stated in the notice by Kenya’s Central Bank, this means that “no protection exists in the event that the platform that exchanges or holds the virtual currency fails or goes out of business.”26Public Notice: Caution to the Public on Virtual Currencies such as Bitcoin, (Nairobi, Central Bank of Kenya, 2015). https://perma.cc/EE4P-UZ57 (accessed June 27, 2021) While consumers should heed this warning, recipients of humanitarian assistance through cryptocurrency are less likely to suffer from market crash or devaluation as the assets which are held against the cryptocurrency tend to be recognized tender outside of the system with most beneficiaries cashing in their cryptocurrency upon receipt.

Conclusion

The use of cryptocurrency and blockchain technology within the humanitarian sector is growing and can be a viable alternative to traditional cash transfers, though it will take time to optimize. Not only are United Nations organizations exploring ways to integrate cryptocurrency into their cash programming, but independent initiatives such as impactMarket are teaming up with humanitarian organizations to distribute cash to those in need. impactMarket has significantly expanded the reach of grassroots fundraising through its unique approach that allows anyone to create a community of beneficiaries and/or to be a donor and identify a community in need. This concept is likely to catch on with bigger organizations adopting similar models as humanitarian funding streams dry up due to lack of government support.

To prepare donors and beneficiaries of the transition from traditional cash assistance models to the use of cryptocurrency, organizations need to provide education to beneficiaries and donors as well as generate buy-in from local merchants to facilitate cash withdrawals or purchases using cryptocurrency. This is currently being done on a small scale, but to ensure acceptance and viability within the humanitarian sector, it will need to become integrated into humanitarian programming. Humanitarian organizations also need to work together with governments to provide education on cryptocurrency and help to provide a bridge of understanding between traditional financial institutions and digital financial infrastructure. It is critical for banks and governments to understand and acknowledge the role cryptocurrency and blockchain can play in overcoming barriers for the unbanked without threatening the space that traditional banks within a country occupy. Digital currency is undoubtedly the cash of the future and governments will need to establish policies to assist with data protection of donors and beneficiaries as well as allowing individuals and businesses to hold digital assets safely and legally.

Based on your interests, you may also wish to read:

- Imperial Reckoning: an exceptional investigation into the violence and brutality which characterized the end of empire in Kenya

- Prosperity & Poverty in Post-Independent Africa Debated

- Artificial Intelligence in the Modern World: Sub-Saharan African Perspective

- An Emerging Landscape of Terror in Mozambique: Implications for the Southern African Development Community